- The Bank

- People

- All Services

- Private Banking

- Savings and Investment

- GoBulling Platforms

- Institutional and Corporate

- Insights

- Login My.BancoCarregosa

- Contacts

Enter your Username to gain access to your Bank. Complete your authentication on the next screen.

If you are not yet a client, open your account here or contact us for more information

Financial markets: 5 highlights for 2024

Learn about 5 highlights for financial markets in 2024, from decentralisation to AI.

There are a number of trends emerging in the financial markets that are challenging the traditional norms. Investors now have the opportunity to reposition themselves and adapt their strategies to maximise returns in a constantly evolving financial environment. Here are 5 of the hot topics for 2024 to consider.

1. Artificial intelligence models trained on financial data will open up new perspectives for investors

This was perhaps the most striking trend of 2023, and all signs point to the increasing integration of artificial intelligence and machine learning into financial markets continuing to shape 2024. Increasingly, financial platforms use sophisticated algorithms to analyse data, predict markets and automate investment decisions.

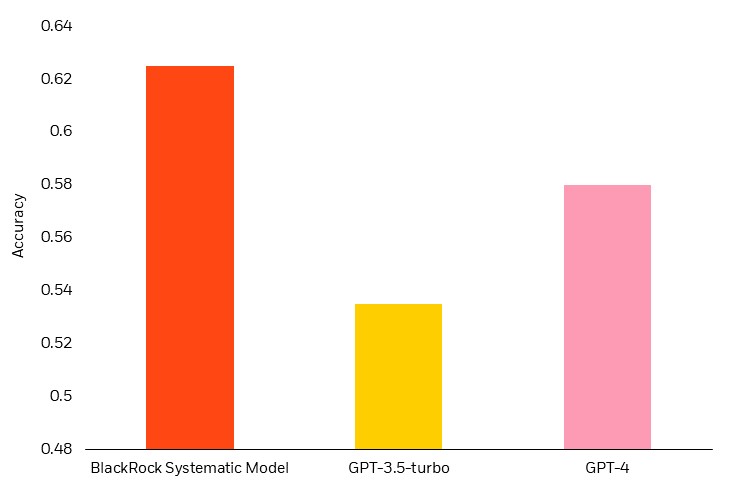

In addition to general-purpose tools, of which OpenAI’s ChatGPT is the most widely used, other platforms trained on financial data are emerging to provide more accurate recommendations to investors. Some "significant” examples are Bloomberg GPT, which is developing a generative artificial intelligence model, and BlackRock, which has developed its own language model (LLM) pre-trained with large amounts of data. The latter model already outperforms ChatGPT on the financial side, as can be seen in the chart below, with BlackRock’s model predicting subsequent earnings after the companies’ statements of profit and loss more accurately than ChatGPT’s models.

[Source: BlackRock]

As AI becomes more widespread, new "fine-tuned” models will be created and improved for performing and predicting financial tasks, especially when it comes to analysing market sentiment and integrating "virtual agents” into corporate workflows.

Investors can take advantage of this trend by adopting data-driven investment strategies, thereby reducing risk. However, it is important to take a cautious approach to information processing and to strike a balance between automation and human analysis.

2. 2024 could be the year of massive fiscal decentralisation – but history suggests caution

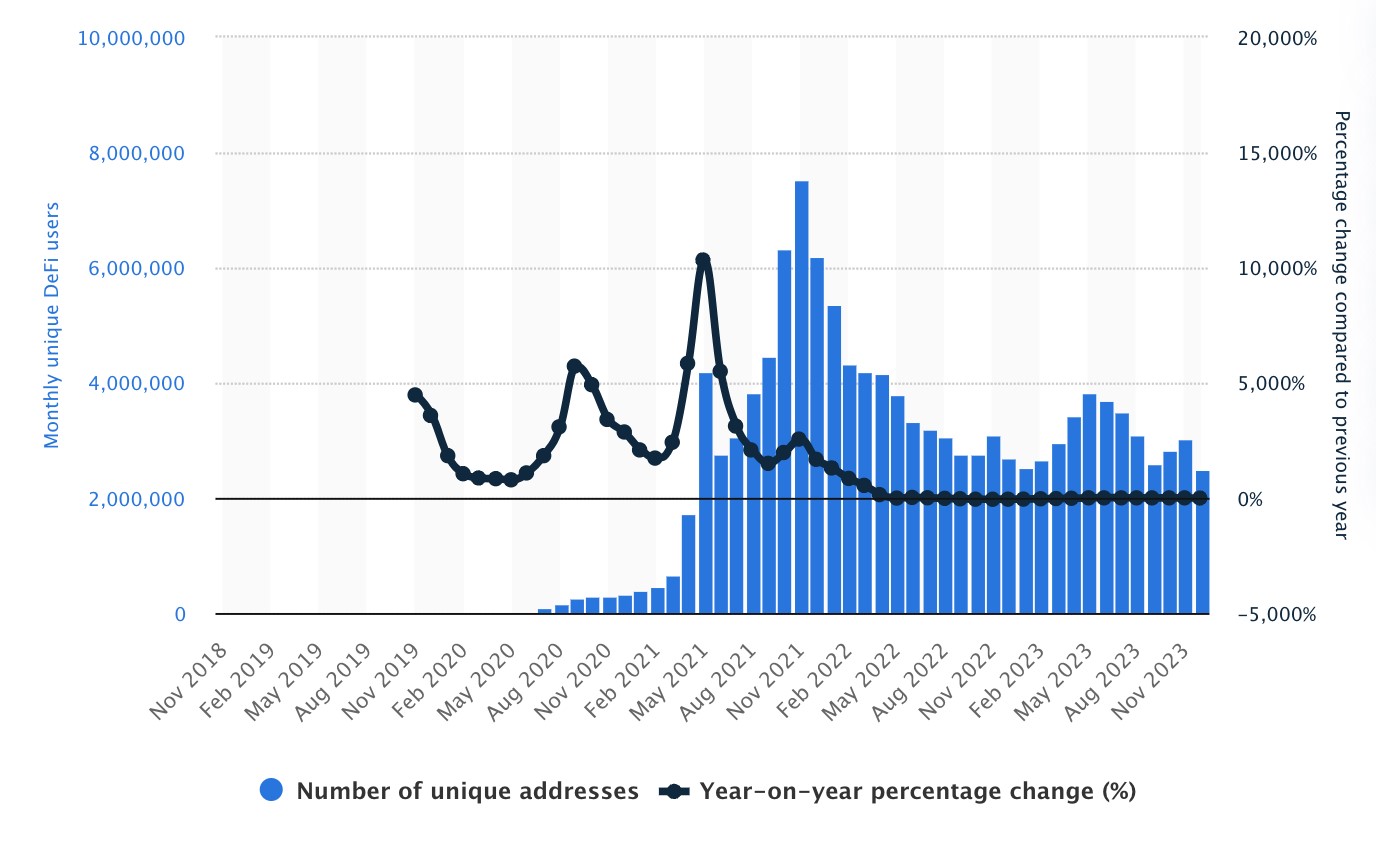

The trend towards financial decentralisation was one of the most promising for 2023 (and also for 2022). Perhaps for this reason, the falling numbers of DEFI users over last year has taken many investors by surprise. Although it has not yet achieved the market penetration expected, there is little doubt that the technology has enormous potential.

Source: Statista

The DeFi protocol uses blockchain-based smart contracts to facilitate financial transactions, and investors can take advantage of this trend in a number of ways. One of these is investing through ETPs ("Exchange Traded Products”), which provide exposure to cryptoassets with a focus on DeFi . It is expected that DeFi platforms will continue to expand, offering more and more options to investors, although regulation will play an important role in the widespread of these platforms.

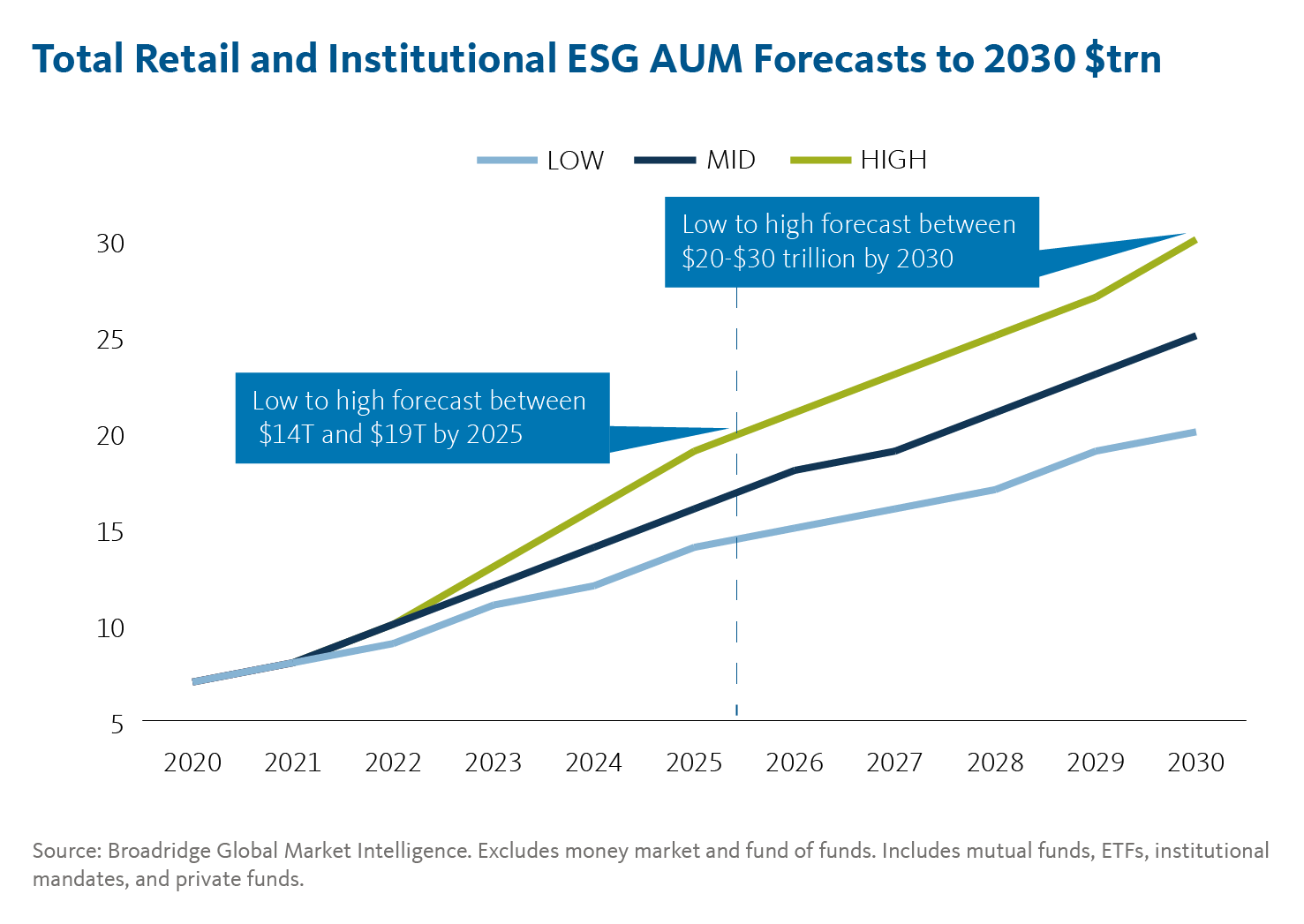

3. Sustainable and ESG investing will be on the rise over the next decade

It is estimated that demand for socially responsible investments will continue to grow through 2024, driven by environmental and social awareness. Some analyses even suggest that assets in ESG funds could reach $30 billion by the end of the decade.

To take advantage of this trend, investors need to select investments in line with ESG principles, rigorously assess corporate practices and integrate sustainable criteria into their investment strategies. On our website, you will find a selection of thematic investment funds that give investors access to high-potential companies that are committed to sustainability.

4. Over 100 digital currencies issued by central banks

The introduction of central bank digital currencies (CBDCs) is changing the dynamics of global financial systems. Unlike traditional cryptocurrencies, CBDCs are issued and regulated by government authorities, offering greater stability and security. And they are growing at a significant rate. As of June 2023, 11 countries had already introduced CBDCs, another 53 were in advanced planning stages, and 46 were researching the issue.

Investors can take advantage of some indirect ways to benefit from the impact of CBDCs on the financial market, such as investing in companies developing blockchain technology or in ETFs that track the performance of companies involved in the implementation of CBDCs.

5. Tokenisation will reach more and more physical assets

The tokenisation of assets, i.e. the conversion of physical assets (such as real estate, gold, commodities or works of art) into their digital equivalent, is reaching more and more areas of trading. Some protocols already allow investment in "fractional” units of these physical assets, such as real estate, allowing direct investment in specific properties. In other words, unlike investing in property funds or REITs, where the investor directly buys an "aggregate!” of properties, fractional investments allow the investor to build a portfolio of individually selected properties.

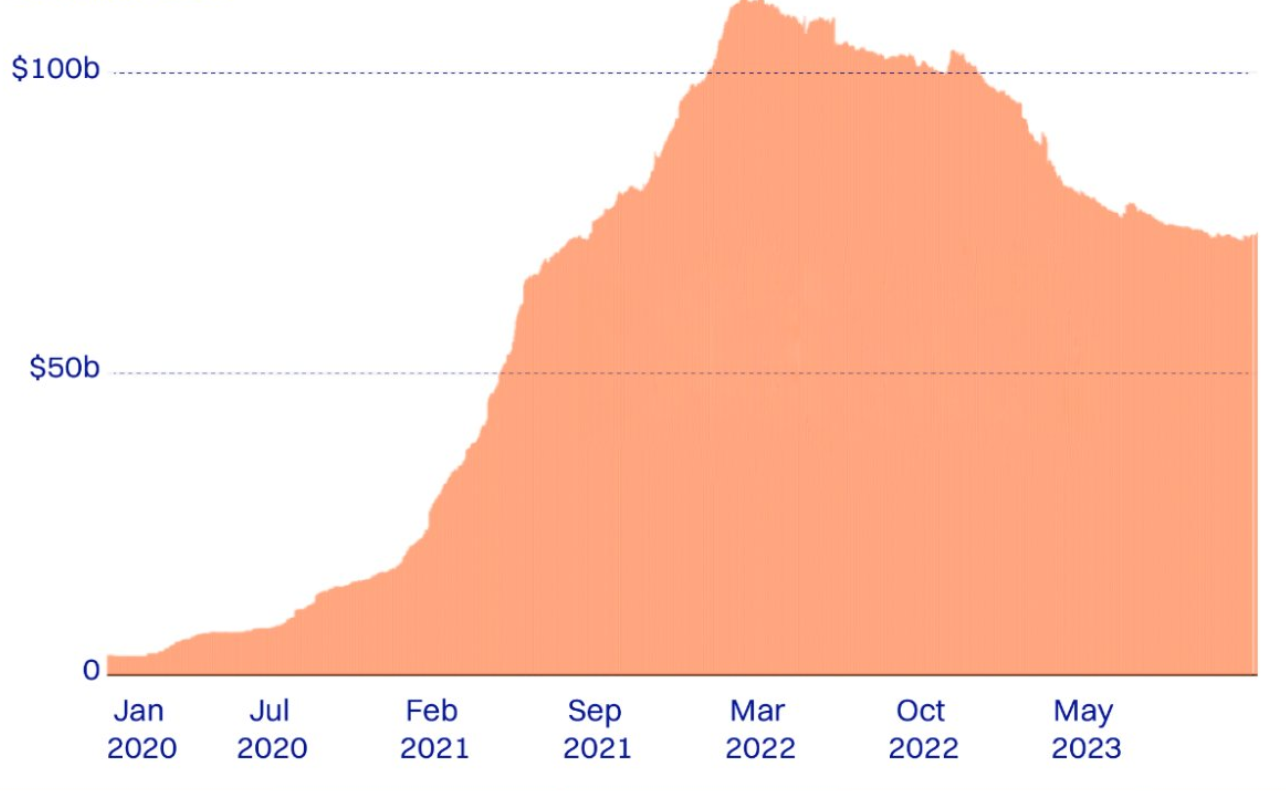

By November 2023, the value of tokenised assets had already exceeded $73 billion. Nearly $4 billion of this was already in physical assets – and this is expected to more than double by 2030.

Source: CoinMarketCap

This financial market trend is opening up access to the buying and trading of a wide range of assets that would otherwise be less liquid and more difficult to trade. Schroders estimates that, by 2030, the tokenisation of illiquid assets will represent 10% of global GDP in investment opportunities.

Investors can take advantage of this trend by buying tokens directly that represent specific assets, such as commercial property, works of art, commodities or even shares in companies. In addition, some investment funds are now being tokenised, making it possible to buy tokens representing holdings in a fund.

Banco Carregosa, in line with financial market trends

These are just some of the main trends in the financial markets for 2024. However, there are other strategies that may be better suited to your profile and long-term objectives. To find out which investment approach is best for you, it is essential to have the specialised support of Banco Carregosa. Contact us and get the support you need to protect and grow your wealth.