- The Bank

- People

- All Services

- Private Banking

- Savings and Investment

- GoBulling Platforms

- Institutional and Corporate

- Insights

- Login My.BancoCarregosa

- Contacts

Enter your Username to gain access to your Bank. Complete your authentication on the next screen.

If you are not yet a client, open your account here or contact us for more information

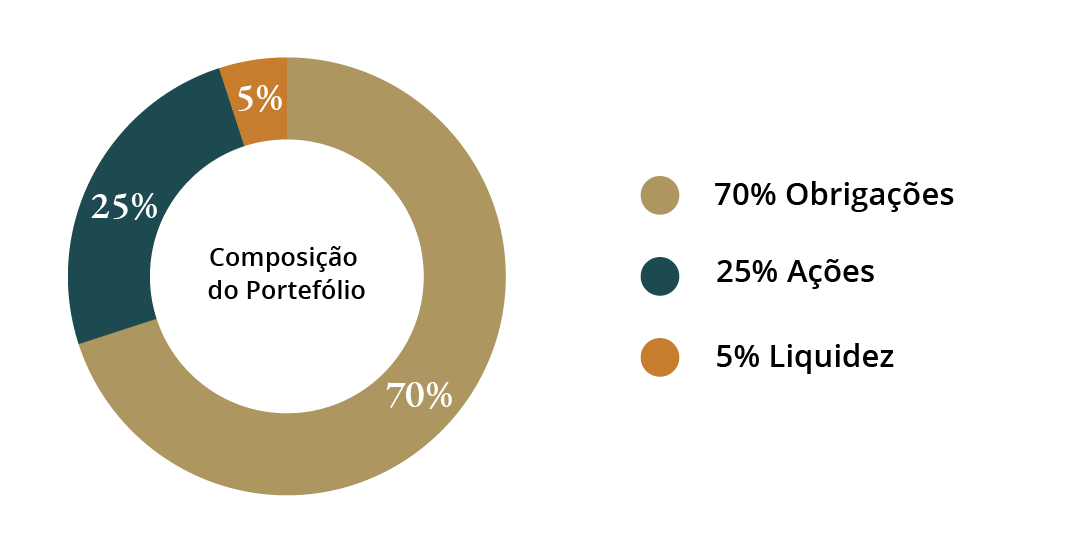

Investment Fund Selection | Defensive

Preservation of capital adjusted for inflation. Conservative strategy both in the selection of assets that make up the portfolio and in the monitoring thereof. Active, risk-averse management seeks to deliver a return above inflation.

Characteristics

- Portfolio made up mostly of bonds.

- Preservation of capital adjusted for inflation.

- Minimum recommended investment horizon: 3 years.

- Risk rating: Low.

Access conditions

Minimum amount: €10,000.

Portfolio Composition

Note: The amount to be invested must respect the minimum subscription amount for each selection and must be calculated in multiples of €1,000.00.

Customer Support Line

Hours: Monday to Friday, from 09:00 to 19:00.

Cost of calling the national fixed network.

Contact

Legal Information

The information contained herein was selected by Banco Carregosa from sources believed to be reliable, based on publicly available data or facts.

The choice of funds that make up each "Selection of Investment Funds" and the definition of the respective risk profiles established by Banco Carregosa do not constitute any offer, recommendation or solicitation for the transaction of any financial instrument - click here to see how the selection is done.

Potential investors are responsible for their investment decisions, and should carefully consider their investment objectives, financial situation, tolerance and capacity to bear the risk of investing in the financial instruments in question.

The "Selections of Investment Funds" presented herein do not take into account any personal element of a specific potential investor. No elements were considered to assess the suitability of any investment or disinvestment to a specific person, therefore it should not constitute an investment recommendation.

The selections shown are not suitable for all investors.

Potential investors should make their own investment decisions and obtain professional clarification and advice on the characteristics and risks of the services and financial instruments in question, appropriate to their level of knowledge and experience, in particular, of price changes and possible loss of capital.

Any subscription or redemption orders are the sole responsibility of the potential investor, and before any investment decision is made potential investors must acknowledge and accept the terms and conditions of the documents specific to each Fund, which are available for consultation herein, including the "Prospectus" and the "Key Information Document" (KID).

Management Companies may share with Banco Carregosa, as distributor, a portion of the Management and/or Distribution Fees charged by the fund, as well as offer other non-monetary benefits. Non-monetary benefits are understood to be the access to research and investment recommendation documents and access for Banco Carregosa employees to conferences and training organised by the Management Companies. In any case, the receipt of these fees does not compromise the independence of Banco Carregosa.