- The Bank

- People

- All Services

- Private Banking

- Savings and Investment

- GoBulling Platforms

- Institutional and Corporate

- Insights

- Login My.BancoCarregosa

- Contacts

Enter your Username to gain access to your Bank. Complete your authentication on the next screen.

If you are not yet a client, open your account here or contact us for more information

VIP Fund

The Fundo VIP, created in 1987, is an open-ended property investment fund with yield distribution. It offers the opportunity to invest in a diversified portfolio of assets that are attractive in terms of demand and appreciation.

– The Fundo VIP is made up of autonomous assets, owned by the participants, essentially located in the main urban centres.

– The properties that are part of the VIP Fund assets are earmarked primarily for offices, warehouses, commerce, industry, educational establishments, culture, tourism, and health and leisure.

– The VIP Fund - Valores e Investimentos Prediais, Fundo de Investimento Imobiliário Aberto, is managed by SILVIP – a property investment fund management company.

General Conditions of the VIP Fund

| Type of fund | Open-ended Property Fund |

| Portfolio composition | Minimum of 75% in property investments |

| Distributions | Quarterly - 15 March, June, September and December |

| Clients | Private clients and companies |

| Appropriate investment horizon | More than 3 years |

| Risk level | 1 |

| Minimum subscription | 5 investment units, and multiples of 5 units for larger amounts |

| Subscription fee | Exempt until 31/12/2024; Thereafter: < EUR 2,500,000 - 1% > or = EUR 2,500,000 and < EUR 5.000.000 - 0.5% > or = EUR 5,000,000 and < EUR 10,000,000 - 0.5% > or = EUR 10,000,000 - 0.125% |

| Reinvestment | Net yield distributed quarterly may be automatically reinvested in the acquisition of new investment units, free of fees. |

| Repayments | As per the Prospectus. |

| Repayment fee | Investment units up to 3 years, inclusive – 1.5% Investment units between 3 and 5 years, inclusive - 1% Investment units between 5 and 10 years, inclusive – 0.5% Investment units for more than 10 years – 0.25% |

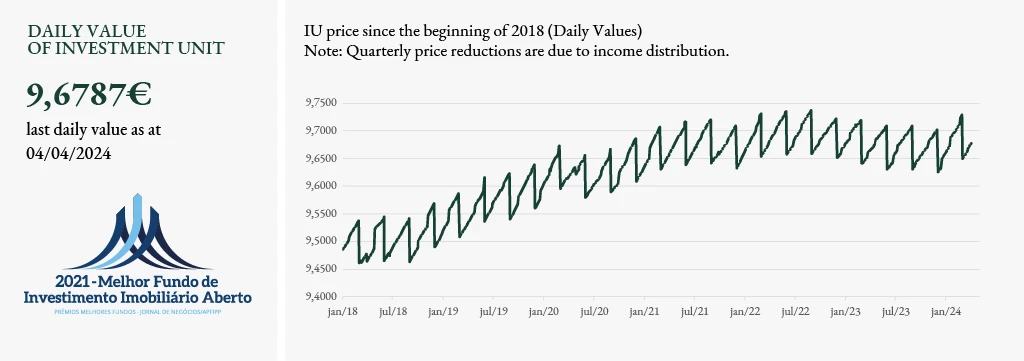

Returns on investment

Periods reported as at the last working day of: | Invest. unit value used for the following working day (in €) | Position - Annualised yields (%) (1) - Last 12 meses | Position - Annualised yields (%) (1) - Last 3 years | Position - Annualised yields (%) (1) - Last 5 years |

Source: APFIPP – Yield measures excluding subscription and redemption fees.

Notes:

For the periods from 2011 to June 2015, as indicated above, the risk measure falling within classes 1 to 7 is classified as 1 (low risk), in accordance with Article 46 of the CMVM Regulation No. 8/2002. For the subsequent periods, with the entry into force of Regulation 2/2015, and in accordance with Article 74, the risk classification is still 1 (low risk) among the 7 risk classes.

a) As of 1 July 2015, yields are considered to be gross values, its income tax being borne by the investor.

(1) For annualised yields over 1 year it should be noted that such yields would only be obtained if the investment was made over the entire reference period (2, 3 or 5 years). Annualised yields are only calculated annually.

Past yields are not a reliable indicator for future results. Investing in funds may result in the loss of the invested capital if the fund is not a capital guaranteed fund.

See the KID and the Prospectus.

Warnings

This information does not replace the need to read the contractual information as required by law, the Key Information Document (KID) and the Prospectus. This information is available at Banco Carregosa, at www.bancocarregosa.com, or on the CMVM website.

Customer Support Line

Hours: Monday to Friday, from 09:00 to 19:00.

Cost of calling the national fixed network.