- The Bank

- People

- All Services

- Private Banking

- Savings and Investment

- GoBulling Platforms

- Institutional and Corporate

- Insights

- Login My.BancoCarregosa

- Contacts

Enter your Username to gain access to your Bank. Complete your authentication on the next screen.

If you are not yet a client, open your account here or contact us for more information

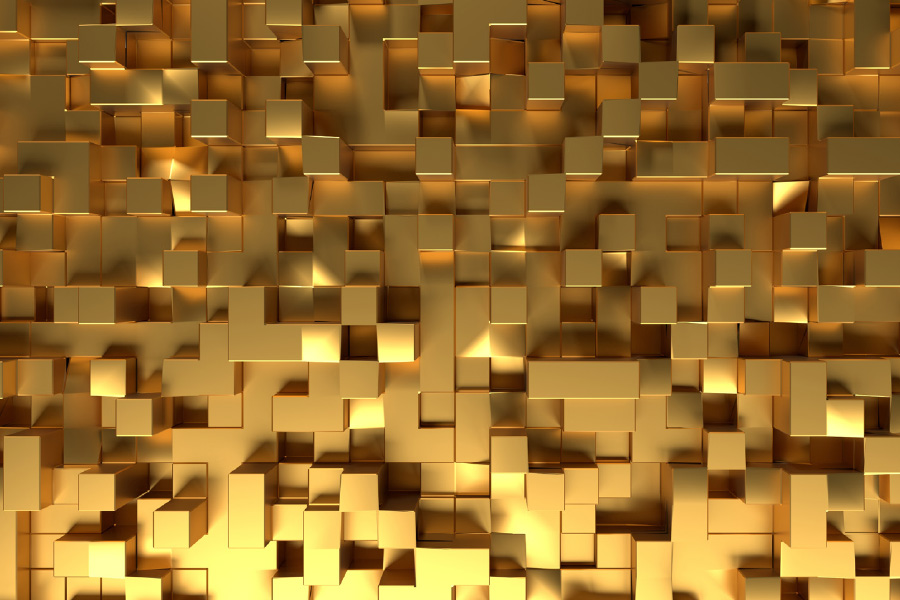

Gold | Precious Metals

Precious metals, such as gold or nickel, are safe haven assets par excellence.

The demand for gold and precious metals tends to increase at times of greater insecurity.

In times of greater uncertainty they are almost always sought out as a diversifying and stabilising element and as a vehicle for minimising losses.

Discover solutions for investing in gold bars, Investment Funds, ETFs and other instruments with exposure to gold and other precious metals.

Gold Bars

An asset with universal and timeless value, and with weak or negative correlation to the financial market.

— BC-Hafner gold bars, the oldest family-owned refiner of precious metal in Germany, with over 168 years experience, specialising in the refining and recycling of precious metals.

— Bars wrapped in a sealed tamper-proof package featuring the unique serial number.

— Banco Carregosa ensures the purchase, sale, safe keeping and withdrawal of precious metals.

Investment Funds

Through investment funds,you can diversify your exposure as, depending on the Fund’s management strategy, you maybe exposed to several variables of the gold “universe” such as, for example, mining companies or companies related to other precious metals.

ETFs and other forms of exposure

You can also explore other forms of exposure by using theGoBulling PRO trading platform.

ETFs are an example of other instruments that allowexposureto gold and that investors can trade. Like Investment Funds, ETFs allow for diversification of exposure and are listed and traded on an exchange.

Mining EFTs

* data as at 31 March 2024

Physical Gold ETFs

* data as at 31 March 2024

For additional legal information, please click here.

Customer Support Line

Hours: Monday to Friday, from 09:00 to 19:00.

Cost of calling the national fixed network.