- The Bank

- People

- All Services

- Private Banking

- Savings and Investment

- GoBulling Platforms

- Institutional and Corporate

- Insights

- Login My.BancoCarregosa

- Contacts

Enter your Username to gain access to your Bank. Complete your authentication on the next screen.

If you are not yet a client, open your account here or contact us for more information

Copper price: what influences the price, risks and opportunities

Find out what influences the price of copper, the risks and how you can invest in copper.

Copper was the key to electrifying the world over 100 years ago. Although it has never really been out of the picture, it is once again in the sights of investors as the future becomes increasingly dependent on alternative energy solutions. One of the first metals mastered by man and the third most widely used metal in the world, copper is used in a wide range of sectors, from shipbuilding to oil exploration. But there are still many mysteries surrounding this metal: what influences its price? What are the investment risks and opportunities?

Copper market: an overview

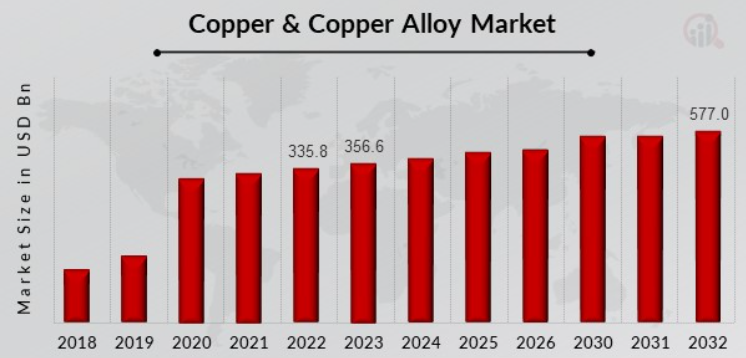

The global market value of copper is estimated at $335 billion in 2022 and is expected to reach $577 billion by 2032, representing a compound annual growth rate (CAGR) of 6.2 per cent over the 10-year period.

[Source: Market Research Future]

Copper can be seen as a cyclical indicator, reflecting the outlook for future economic development. There are three distinct phases in the recent history of copper:

• The copper cycle era (pre-2002): during this period, demand for copper was driven by industrial production, and its power as a barometer of economic activity was highlighted, earning it the title of "Doctor Copper”.

• The China era (2002-2018): during this period, demand for copper was boosted by the accelerated growth of the Chinese economy and urbanisation. This period became known as the "commodity supercycle”.

• The era of net-zero targets (from 2018): in this new era, net-zero targets, together with government policies, will drive demand through the energy transition, coupled with acceleration in copper demand.

How will copper demand develop?

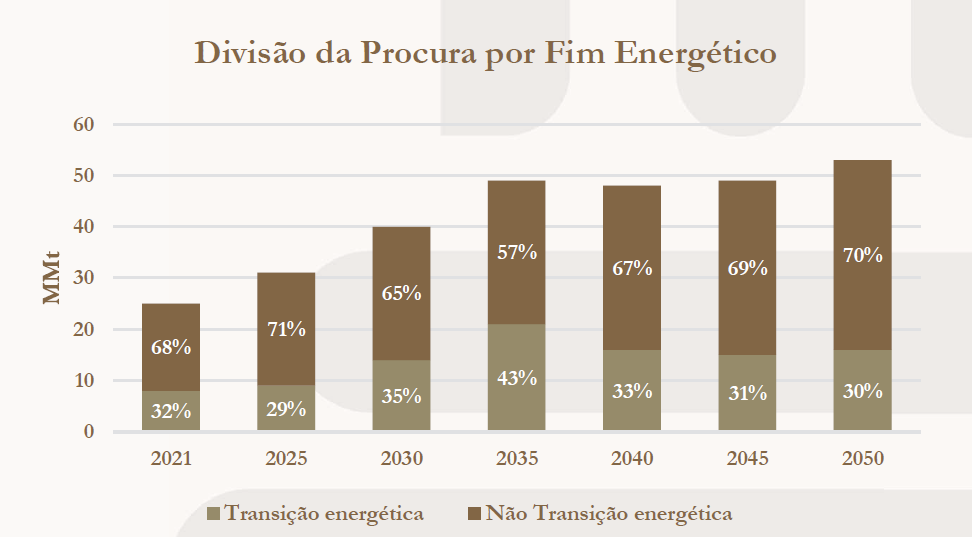

The development of renewable energies is and will continue to be the main driver of the demand for copper in the coming decades. In this sense, it is important to segment the main components of the energy transition plan, which in the long term will contribute to increasing annual global copper demand from 25 Mt (million tonnes) today to around 53 Mt in 2050.

Electrification of the transport system

Copper is essential to make motors, batteries and control systems used in electric vehicles. The IEA predicts that the number of electric vehicles sold in 2030 will be 6.6 times higher than in 2021. According to the International Copper Association, electric vehicles use approximately 3.8 times more copper than internal combustion engine (ICE) vehicles. The banning of internal combustion vehicles in the UK (2030), the European Union (2035), California (2035), Canada (2035) and China (2035) will significantly drive the transition process and consequently the global demand for copper, which could account for more than 10% of demand.

Expansion of renewable energy infrastructure

The growing number of renewable energy installations such as solar and wind require extensive electrical systems, of which copper is a critical component. In fact, the production of electricity from sunlight and wind means that the demand for copper per MW is twice that of nuclear and fossil fuel generation.

Demand for copper from the energy transition is expected to peak in 2035 at around 21 Mt and then gradually decline until 2040, before stabilising in 2050. Demand from traditional markets is expected to grow steadily until 2050, with an average growth rate of 2.4%. Apart from the energy transition, demand from traditional markets will continue to account for the largest share of global demand at 57%.

Technological developments

Copper is essential to a wide range of devices used in modern life. Copper is needed in virtually all devices that use electrical components and circuits, not just smartphones and computers. In addition, advances in the "Internet of Things” (IoT), artificial intelligence (AI) and emerging technologies will continue to drive the need for more efficient and compact electronic components, which in turn will increase demand for copper.

What influences the price of copper?

The price of copper is influenced by a number of factors, reflecting the complexity of the commodities market.

The main influencing factors are:

1. Supply and demand

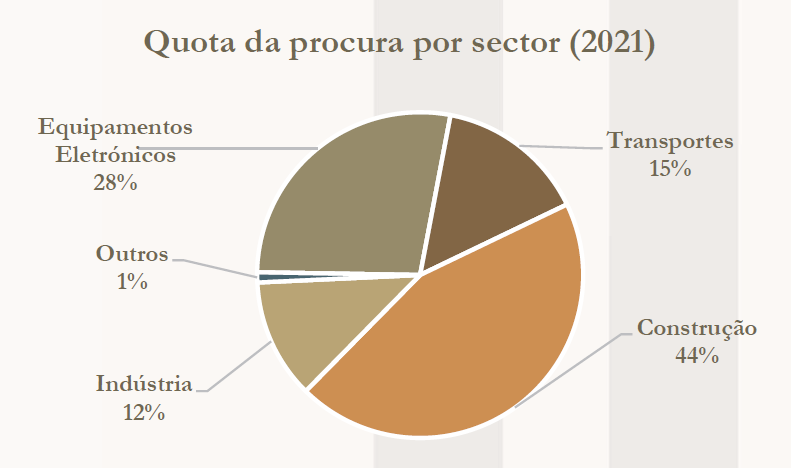

As with any asset, the price of copper is driven by supply and demand. For copper, demand is expected to grow exponentially over the long term and the structural gap between supply and demand is expected to widen to historic highs. Demand for copper is growing, particularly in sectors such as construction, electronics, electric vehicles and renewable energy. On the supply side, the copper market has a highly concentrated supply chain. This means that the world’s major consumers rely heavily on China. As a result, the response to the growing use/consumption of copper depends on the development of the supply chains, not only through production but also through recycling.

2. Global economic conditions

The copper price is sensitive to global economic conditions. During periods of economic growth, demand for copper tends to increase, pushing up prices. Conversely, in times of economic slowdown, demand may decline, pushing down prices.

3. Monetary policy and interest rates

Monetary policy and interest rates affect the cost of financing for mining and exploration companies and can influence production costs and, consequently, the price of copper.

4. Climate and geopolitical conditions

Extreme weather events such as storms and droughts can affect copper production. Geopolitical conditions, such as instability in producing countries, can also affect supply and lead to price fluctuations.

5. Production costs

The production costs of mining, transporting and processing have a direct impact on the price of copper. Potential increases in the cost of energy, labour, equipment and environmental regulations could push up prices.

6. Exchange rate

As copper is generally priced in US dollars, fluctuations in exchange rates can affect prices in other currencies. The appreciation or depreciation of the dollar can affect the attractiveness of copper as a commodity.

7. Technological innovations

Technological advances with a direct impact on copper production, such as more efficient mining and processing methods, can affect supply and therefore prices.

8. Developments in the electric vehicle sector

As copper is widely used in electric vehicles, developments in this sector, such as changes in incentive policies, technological advances and growing market acceptance, could influence copper prices through increased demand.

Risks of investing in copper

Investment in copper, as with any commodity, carries a number of risks that investors must take into account when making financial decisions. Given the complexity of the market, it is important to carefully assess all risks, diversify portfolios and monitor economic and geopolitical conditions that may have an impact on the copper market.

1. Price volatility

The market for commodities, including copper, is highly volatile. Prices can be affected by a number of factors, including global economic conditions, geopolitics, supply and demand, which can result in unpredictable price movements.

2. Dependence on the global economy

Demand for copper is closely linked to the global economy. During periods of economic slowdown, demand for commodities such as copper can fall, adversely affecting prices.

3. Geopolitical risks

Political instability in major copper producing countries can affect supply and lead to price fluctuations. Potential conflicts, changing government policies and regulatory issues are examples of geopolitical risks that investors should consider in their investment strategies.

4. Slowdown in the Chinese economy

As China is one of the world’s largest consumers of copper, any significant slowdown in its economic growth could have a direct impact on the global demand for copper.

5. Replacement by alternative materials

Technological innovation or changes in market preferences may lead to copper being replaced by alternative materials in certain applications, affecting demand and prices. For example, aluminium alloys and composites can be alternatives to copper in some specific applications, with similar or better properties in terms of lightness, corrosion resistance and electrical conductivity.

6. ESG criteria

Copper mining and processing involves a wide range of environmental and social risks, often linked to governance issues. Both open pit mining and refining are associated with high levels of pollution. As a result, regulation has become increasingly stringent, increasing costs, decreasing incentives and, consequently, reducing production levels.

Investment opportunities

Despite the risks associated with investing in copper, there are significant opportunities for investors seeking exposure to this market, especially if they have good advice from specialist financial advisers.

Copper mining stocks

A direct way to gain exposure to commodity price movements is to invest in the shares of copper mining companies.

Industrial metals ETFs

Exchange Traded Funds (ETFs) that track the performance of industrial metals, including copper, offer a diversified approach. Some ETFs track specific metal indices, offering a way to invest directly in the copper market.

Copper futures contracts

Investors with more experience, or with the help of a financial advisor, may choose to trade copper futures contracts on commodity exchanges. These contracts allow you to speculate on price movements, but also involve a higher level of risk and require a deeper understanding of the market.

Commodity funds

Investment funds allocated to commodities, including copper, allow investors to diversity into industrial metals.

Banco Carregosa, expert advice on investing in copper

Copper is one of the metals that investors should consider for portfolio diversification and exposure to a key market for the coming decades. To make informed decisions according to your objectives, seek the expert advice of Banco Carregosa and benefit from our decades of experience in a dynamic and ever-changing market environment. Contact us.