- The Bank

- People

- All Services

- Private Banking

- Savings and Investment

- GoBulling Platforms

- Institutional and Corporate

- Insights

- Login My.BancoCarregosa

- Contacts

Enter your Username to gain access to your Bank. Complete your authentication on the next screen.

If you are not yet a client, open your account here or contact us for more information

Cryptoassets: what are they and how are they used in the financial markets?

Find out what cryptoassets are, what you need to look out for and how you can invest in them for the long term.

The uptake of cryptoassets by Portuguese investors is already above the European average – around 12% of respondents are or have been cryptoasset investors. But are cryptoassets suitable for all investors? How to benefit from the trend? What risks should be avoided? And what exactly are they? Find out what they are and how they are used in the financial markets.

What is a cryptoasset?

A cryptoasset is a digital asset that uses cryptography to ensure the security and immutability of transactions made over the network. The term is often associated with cryptocurrencies, which are a subset of digital assets. Cryptocurrencies are virtual currencies that operate through a technology called blockchain, which can be centralised or decentralised.

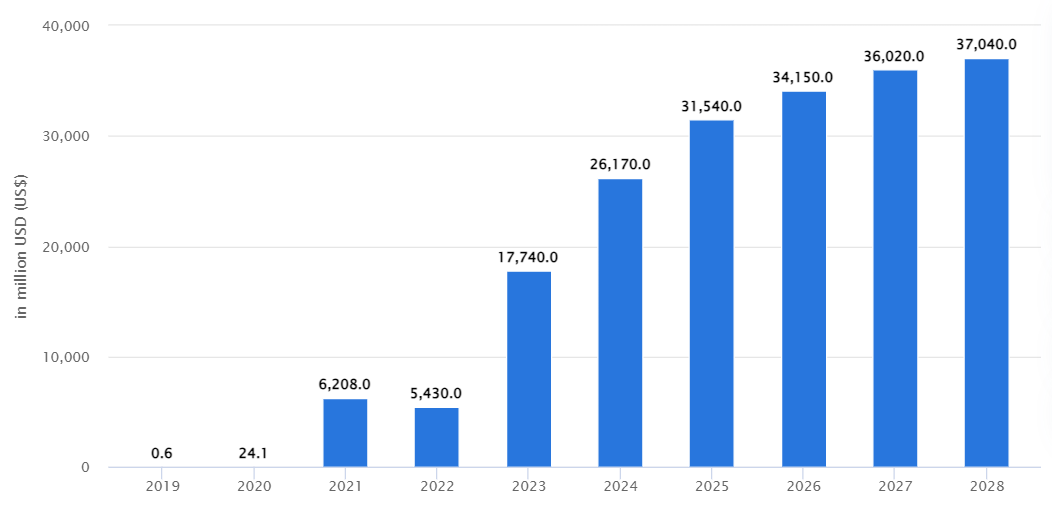

Historical cryptocurrency market capitalisation to date.

Source: crypto.com

Blockchain, on the other hand, is a distributed ledger that records all transactions made with a given cryptocurrency. This technology is fundamental to ensuring the security and transparency of transactions, as it prevents data falsification and duplication.

Bitcoin, Ethereum, Ripple and Litecoin are some examples of cryptocurrencies, but there are many others on the market. In addition, the term "cryptoasset" can be used more broadly to include other types of digital assets, such as tokens that represent physical assets, smart contracts that are automatically activated when certain conditions are met, or participation in specific projects or rights.

How can cryptoassets be used in financial markets?

Cryptoassets can be used in a number of ways in the financial markets, and their role is evolving. Some of the main uses are:

1. DeFi, decentralised finance

DeFi refers to a set of financial services without intermediaries, in order to create an open and transparent system. DeFi uses smart contracts on a blockchain platform to automate and decentralise financial functions.

Revenue from DeFI products and services

[Source: Statista]

Revenues from DeFi solutions are forecast to reach $26,170.0 million by 2024, with a CAGR of 9.07% by 2028. For investors, these figures provide investment opportunities, for example through funds that invest in companies with exposure to the DeFi market, or through Exchange Traded Funds (ETFs) that track technology or cryptoasset-related indices.

2. Smart contracts, smart automation

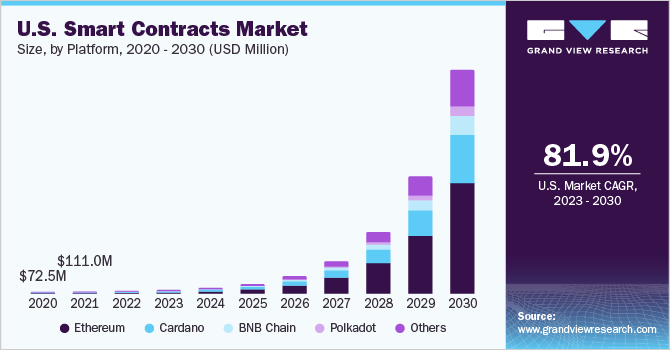

Smart contracts are automatically executable programmes that execute the terms of a contract when certain pre-defined conditions are met. These contracts are implemented on blockchain platforms.

[Source: Grand View Research]

The global market for smart contracts continues to grow, and this growth is expected to increase over the next few years. In fact, as more people adopt the DeFi system, the demand for smart contracts is likely to increase.

3. Stablecoins, reducing volatility

Stablecoins are cryptoassets that aim to maintain a stable value relative to a fiat currency, such as the US dollar or the euro. By minimising the volatility associated with most cryptocurrencies, such as Bitcoin and Ethereum, stablecoins become more suitable for daily transactions, smart contracts and other financial applications.

This cryptoasset is making rapid progress, especially in the foreign exchange market, as it is a key way to reduce fees. Data estimates that the value of stablecoin-based payments will exceed $187 billion globally by 2028.

4. CBDCs, the regulated cryptocurrencies

The acronym CBDCs stands for Central Bank Digital Currencies. They are digital forms of currency issued and guaranteed by a country’s central bank – the ECB is currently planning to develop one, the Digital Euro.

By the second half of 2023, 130 countries were already using this type of currency, representing 98 % of global GDP. There are also 64 countries that are currently at an advanced stage of using CBDCs. In addition, PetroChina has already completed the first international crude oil transaction using the digital yuan (e-CNY).

5. Bitcoin's 2024.

The beginning of 2024 was marked by the SEC approving bitcoin ETFs in the US, bitcoin halving in about 2-3 months (between April and May this year), interest rates reaching a "ceiling” and no further increases are expected. Amongst other things, these 3 phenomena materialised in a bull run to in the market, with bitcoin reaching the $50 000 mark again in February this year.

The interest is not just from retail investors, as there are signs that institutional investors are increasing their exposure to these assets. For example, the discount of funds/trusts/ ETFs holding bitcoin to the value of bitcoin has compressed from the lows of 2023 (around 53 %) to the 0 % mark. What does this mean? In general, retail investors buy crypto assets directly. Institutional investors, on the other hand, do so through the financial market. The compression of this discount implies that institutional interest has increased as they use the "investment channel” they have access to. In addition, inflows into the new BTC ETFs have accelerated since the beginning of the year, with a total of $2.8 billion raised to date. This new investment channel will also have a strong impact on the performance of the class throughout 2024, as new investors feel more comfortable gaining exposure to the securities.

Banco Carregosa, specialised advisory on cryptoassets

Cryptoassets may be a new type of investment, but the lessons for investors are old. There’s the potential for significant gains in cryptoassets, but there’s also the potential for loss of capital – just like any other investment. That’s why it’s important to carry out your due diligence with the help of financial experts. You can count on the Banco Carregosa team to help you make informed investment decisions as part of a diversified portfolio. Contact us, protect your assets and increase the value of your capital.