- The Bank

- People

- All Services

- Private Banking

- Savings and Investment

- GoBulling Platforms

- Institutional and Corporate

- Insights

- Login My.BancoCarregosa

- Contacts

Enter your Username to gain access to your Bank. Complete your authentication on the next screen.

If you are not yet a client, open your account here or contact us for more information

How to choose financial assets

There are many possible strategies for selecting financial assets. However, there are 8 evaluation criteria that all investors should know.

When it comes to choosing a financial investment, investors are faced with a myriad of questions. Is the yield competitive? Is there growth potential? Is it a good time to buy?

What risks and uncertainties should I consider?

Answering these and other questions can be challenging for even the most experienced investors, but it is crucial in determining whether you have made the right decision. As with any good investment decision, the starting point is always an individual’s risk profile and objectives. Whatever financial asset you’re thinking of investing in – stocks, bonds, commodities, funds, or even term deposits – consider these 8 essential evaluation criteria.

1. Track record

As the saying goes, the secret of business is in the buying, not the selling. The purchase price of a financial asset obviously has a direct impact on the potential return. To determine whether it’s a good time to buy a particular financial asset, it is important to analyse its track record. Although past performance is no guarantee of future results, it can provide valuable insights. By analysing the historical price and its volatility, investors can assess the likelihood of further fluctuations in the value of the asset, allowing for more effective risk management.

2. Rate of return

How much will I earn on my investment? This is probably the first question many investors ask when considering a financial investment, whether it is a term deposit or stocks.

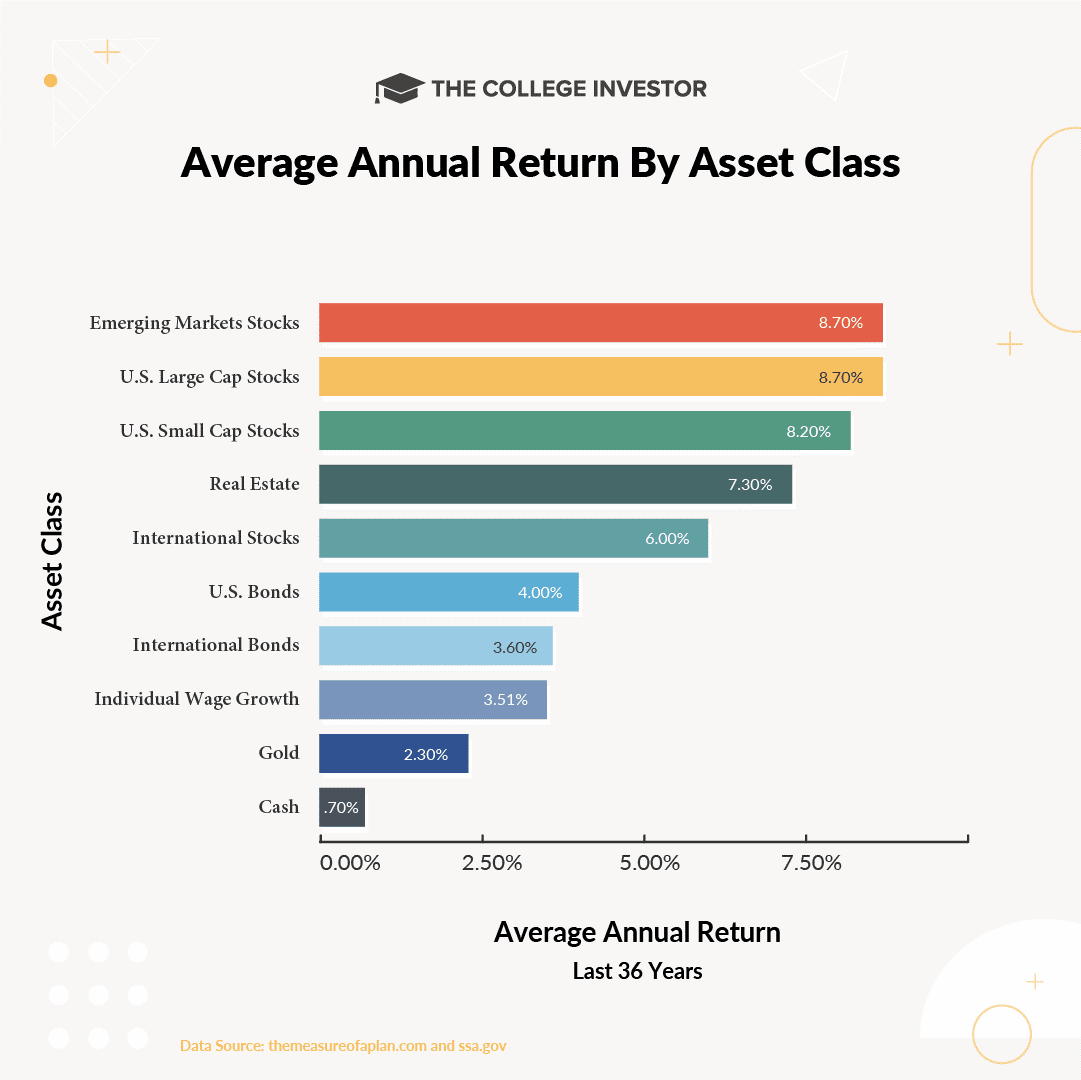

Average annual return by asset class (36-year historical data – 1985 to 2020)

Stocks tend to offer higher returns, but also suffer from above-average volatility. Bonds are historically a less volatile investment, but also have lower average annual returns. The real estate sector, traditionally one of the most popular investment areas in Portugal, has recently gained new momentum with solutions such as REITs, an acronym for Real Estate Investment Trust, or the real estate investment vehicle Sociedades de Investimento e Gestão Imobiliária (SIGI). REITs pay investors dividend income, which is often derived from property rents. As rents tend to be stable, the return to the investor can also be considered stable under normal market conditions.

How do I choose? Firstly, it depends on the investor’s objectives and planning horizon. Secondly, it is important to compare the return prospects with the historical performance of the asset class and with other investment options available to the investor. Finally, it is important to factor in the rate of inflation to get a sense of the estimated real gains from the investment.

3. Risk

Investments should always be analysed from both sides of the coin. While the most obvious side is the return, you shouldn’t ignore the risk associated with that return. In general, the higher the return on a financial asset, the higher the risk.

Every investor has a different tolerance for risk, which is influenced by factors such as financial objectives, time horizon, stage of life and financial situation. You should therefore assess your risk tolerance before making a decision. It is important that the investment you choose matches your risk profile to avoid making emotional investment decisions.

4. Investment horizon

"If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes”. Among Warren Buffett's many mythical phrases, this is one that all investors should bear in mind when buying a financial asset. But the reality is different: today, the average investor holds a stock for just 6 months – an all-time low and almost half of what it was 10 years ago.

Of course, the context is very different today, not least because it’s easier to buy and sell stock than in the past, and online trading platforms allow you to analyse and access information that was previously only available to specialists. But there’s one thing to remember: before you buy an asset, think about how long you’re willing to keep it in your portfolio and under what conditions you’d be willing to sell it.

5. Liquidity

Many people prefer financial assets because they are more liquid than other options, such as investing in real estate, art or precious metals. However, this is not always the case: some financial assets cannot be traded on a daily basis and may even have minimum holding periods before they can be sold.

However, most assets have sufficient liquidity to allow you to sell your position with some ease, and this is one of the factors to consider when choosing a financial investment. Therefore, before you buy a financial asset, you should check that the conditions for holding it are in place and that you can sell it at any time.

6. Know the asset you are investing in

This is one of the decision criteria that is often overlooked by investors, but which is crucial when choosing a financial asset. Good management practices, dividend history and the ability to innovate are some of the key criteria to assess in order to understand the financial stability and suitability of the investment to the investor’s objectives and values.

The so-called "dividend kings” are an elite group of stocks that have increased their dividends every year for at least 50 consecutive years. Of the more than 4,000 public companies in the US, only 54 achieved this status in 2024, with 5 new additions. These companies delivered an average annual return of 9.62%. Over the same period, the equally weighted S&P 500 Index returned an average of 7.30%.

7. Sector of activity

Each sector is affected differently by the different phases of the economic cycle. For example, some industries may be more vulnerable to regulatory changes, while others may be highly dependent on technological innovation. Similarly, some emerging or expanding sectors may offer more opportunities for capital appreciation, while mature sectors may be more stable but have less growth potential.

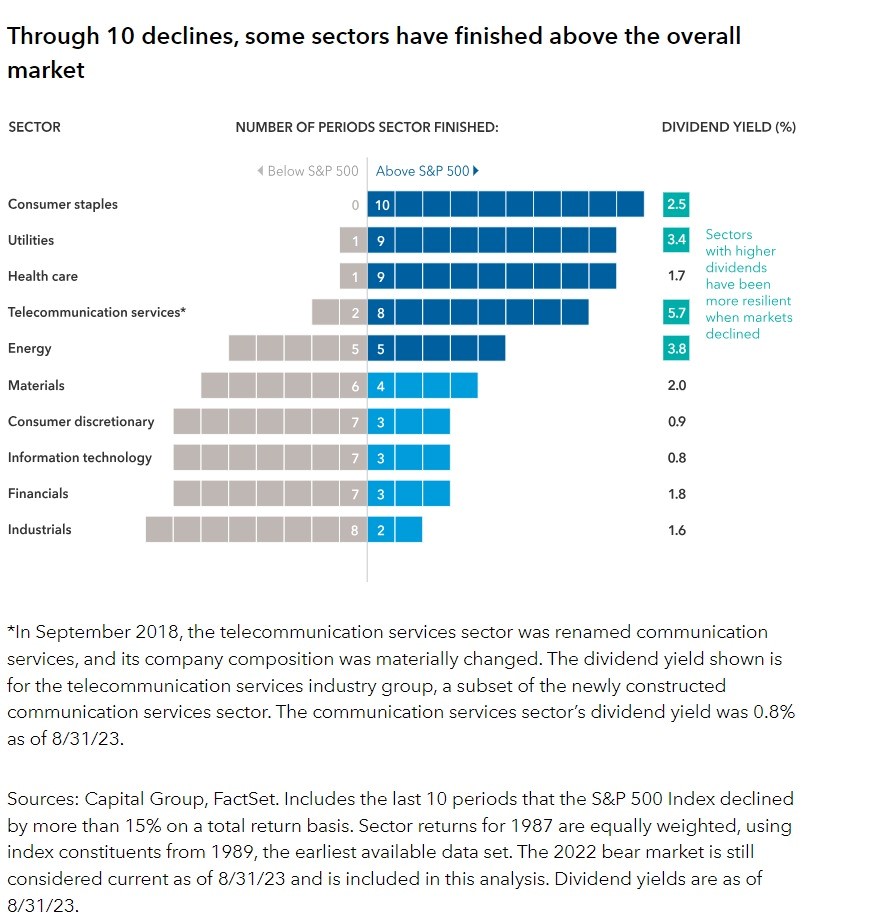

Most resilient sectors analysed over 10 economic cycles

[Source: FundsPeople]

Sector analysis allows investors to adapt their portfolios to macroeconomic conditions, identify growth opportunities and better manage the risks associated with specific sectors. Sector diversification is also a common strategy for reducing overall portfolio risk.

8. Intrinsic value

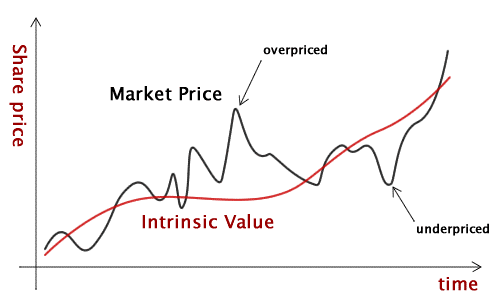

The intrinsic value of a financial asset is critical to understanding its true worth. While market value can be influenced by short-term factors, emotional perceptions and investor behaviour, intrinsic value is an estimate of the cash flow that can potentially be generated over a given period of time.

If the intrinsic value is higher than the market value, there may be potential for appreciation – and this indicates a good time to buy. This discrepancy between values is nothing more than an opportunity to identify assets that are undervalued by the market and could eventually rise in price.

Banco Carregosa helps you make the right investment decisions

By considering these criteria in an integrated way, you can make more informed decisions in line with your financial objectives. If you are looking for personalised advice to optimise your investment choices, the team of experts at Banco Carregosa will provide you with professional advice and help you achieve your investment objectives in a strategic and informed manner. Contact us.